lifepo4 Battery Prices will increase after 2026 CNY? let’s see

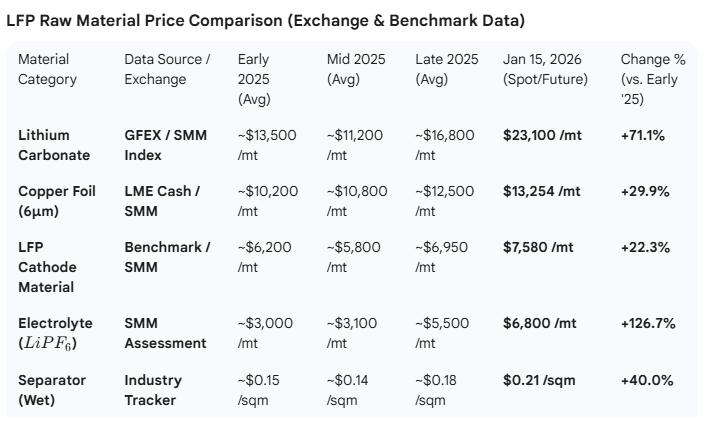

The lifepo4 lithium battery materials industry is experiencing a significant surge in prices, driven by strong demand from both power and energy storage sectors. Lithium carbonate, lithium iron phosphate (LiFePO4), and other key materials have seen prices spike, particularly lithium hexafluorophosphate (LiPF6) and additives like vinylene carbonate (VC). Prices in these sectors have risen sharply as supply chain issues persist and market optimism grows.

Recent data shows that lifepo4 lithium battery’s carbonate’s price has risen by 5.6% since early November, with a nearly 50% rebound since mid-year. Lithium iron phosphate prices also rebounded strongly, with mainstream prices for power-type LiFePO4 reaching 37,000-38,000 RMB/ton. High-end products with higher pressure densities have seen even more significant price hikes, with prices reaching up to 42,000 RMB/ton. This surge is compounded by a rise in processing fees, pushing battery manufacturers to stockpile supplies ahead of further price hikes.

The rise in prices isn’t just limited to raw materials of lifepo4 battery. Lithium hexafluorophosphate, an essential component for electrolytes, has seen an extraordinary price increase of over 220% in just four months. Prices have climbed from 47,000 RMB/ton in July to 151,500 RMB/ton in November. Export prices are even higher, exceeding 160,000 RMB/ton. Similarly, VC, a key additive for electrolytes, has surged in price from 48,800 RMB/ton in early October to 140,000 RMB/ton by mid-November.

Energy storage batteries are under the most pressure from these price increases. Due to intense price competition in the past, energy storage companies are especially vulnerable. Many of these companies were already operating with thin profit margins, and with upstream materials now rising in price, costs will increase. Some battery cell procurement prices are dangerously close to cost floors. The resulting pressure is likely to push energy storage battery prices significantly higher in the near future. However, analysts remain optimistic about the long-term growth of the energy storage market, predicting it will be a major driver of demand for lifepo4 batteries in the coming years.

While the overall battery market is facing upward pressure, power batteries have seen more moderate price increases. Competition in the power battery market remains fierce, especially among automakers under significant cost pressures. As a result, lifepo4 battery manufacturers may be less able to increase prices. Instead, they will focus on technological cost reduction and cost-sharing with automakers. This will likely keep the overall price trend for power batteries stable. However, high-pressure density LiFePO4 batteries are expected to see quicker price increases due to their performance premiums. In contrast, lower-end batteries will face pressure due to fierce competition and rising processing fees.

As these price surges continue, downstream manufacturers are scrambling to secure raw materials to stabilize their supply chains. Major companies have signed long-term contracts to secure supplies, including agreements for millions of tons of electrolyte products. These long-term deals indicate confidence in the future market, which will help support current pricing levels. However, this surge in demand will lead to further market differentiation, with leading companies locking in profits through long-term contracts while smaller players struggle to survive. As a result, industry concentration will continue to increase, and material suppliers will see improved profits in the short term.

Looking ahead, the industry is cautiously optimistic about the future. However, material companies have learned from previous cycles and are being more cautious about expansion. Companies like Tianci Materials and Duofuduo are scaling production more carefully and ensuring it aligns with market demand. Industry conferences have stressed the need to avoid over-expansion and to maintain a reasonable production growth rate. While energy storage demand will drive long-term growth, companies must manage supply chain efficiency to mitigate cyclical fluctuations.

In conclusion, the sharp rise in raw material prices, especially for energy storage, is likely to persist into 2026. The demand for energy storage is expected to drive long-term growth, while rising material costs will push prices up in the short term. However, the battery market will continue to differentiate, with leading companies positioned for growth and smaller firms facing tougher competition. The key to success in this evolving market will be technological innovation, efficient supply chain management, and maintaining strategic control over raw materials. As the industry adapts, it will face both challenges and opportunities in securing sustainable growth.